When and How to Use a Voided Check in Your Finances

Navigating the world of personal finances can sometimes feel like walking through a maze. With so many terms and processes to understand, it’s easy to get lost. One term you may have heard thrown around is “voided check.” But what exactly does it mean, and why might it be important for your financial dealings? Whether you’re setting up direct deposits or establishing automatic payments, knowing how to effectively use a voided check can save you time and headaches down the road. Let’s dive into what a voided check really is and how you can make it work for you in managing your money more efficiently.

What is a Voided Check and How is it Used?

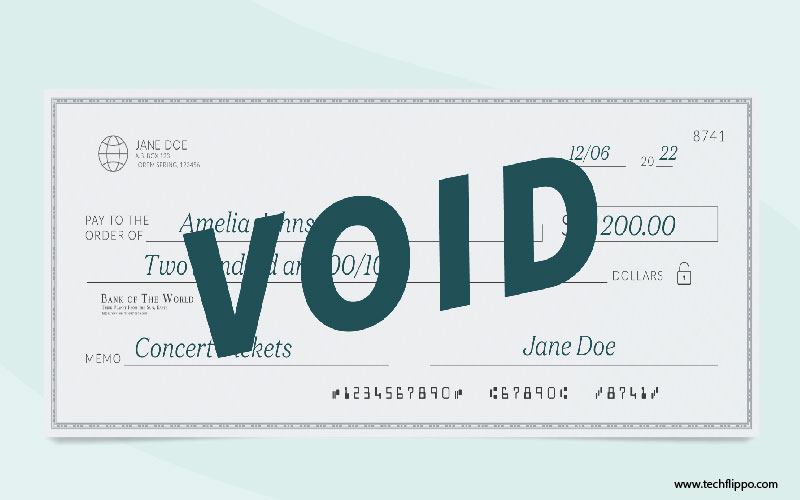

A voided check is simply a check that has been marked as unusable. Typically, this is done by writing the word “VOID” across the front of the check. This action prevents anyone from cashing or depositing it.

Voided checks are often used to provide banking information without risking fraudulent transactions. They include essential details like your bank account number and routing number, making them useful for various financial processes.

Common scenarios involve setting up direct deposits with employers or automatic bill payments with service providers. By submitting a voided check, you can ensure that funds move directly in and out of your account securely.

This method offers convenience while maintaining security, allowing businesses and individuals to streamline their payment methods effectively.

Why Should You Use a Voided Check?

Using a voided check simplifies many financial transactions. It provides clear and reliable banking information, ensuring accuracy when setting up direct deposits or automatic payments.

When you present a voided check, you’re minimizing the risk of errors in your account details. This is particularly crucial for payroll processes where one mistake could lead to delayed payments or funds being deposited into the wrong account.

Additionally, voided checks serve as proof of your banking relationship. This can be beneficial when dealing with lenders or service providers who require verification before initiating transactions.

Moreover, having a voided check on hand can expedite various applications, whether for loans or new services that involve recurring fees. It streamlines the process by providing all necessary details in one go without any extra steps needed to gather bank information separately.

When to Use a Voided Check

Timing is crucial when deciding to use a voided check. One common scenario is during direct deposit setup with your employer. Providing a voided check ensures that your paycheck goes straight into your bank account without any hitches.

Another instance arises when you’re enrolling in automatic bill payments. A voided check offers the assurance that funds will be withdrawn from the correct account, minimizing errors.

If you’re applying for loans or new financial accounts, lenders may ask for a voided check as proof of banking information. This helps streamline processes and verify details.

Additionally, using a voided check can be helpful if you want to set up recurring transfers between accounts. It makes transferring money seamless and prevents miscommunication with banks.

Step-by-Step Guide on How to Use a Voided Check

Using a voided check is straightforward. Start by grabbing one of your checks and writing “VOID” across the front in large letters. This prevents anyone from cashing it.

Next, include your banking information at the bottom. Your account number and routing number are essential here. These details will help verify your bank account when setting up direct deposits or automatic payments.

If you’re submitting this to an employer for payroll, be sure to attach the check securely with any required forms.

For rental agreements or service setups, ensure you provide it alongside other requested documents as instructed.

Always keep a copy of the voided check for your records before sending it out; this can be helpful if any issues arise later on regarding payments or deposits.

Common Mistakes to Avoid When Using a Voided Check

When using a voided check, it’s easy to slip up. One common mistake is failing to clearly write “VOID” across the front. If this step is overlooked, someone might inadvertently use your check for unauthorized transactions.

Another issue arises from not providing accurate information. Ensure that your account and routing numbers are legible and correct. Mistakes here can lead to failed transactions or payment delays.

Avoid giving out a voided check too freely. Treat it like sensitive information, as it contains personal banking details that could be misused if they fall into the wrong hands.

Don’t forget about keeping copies of any correspondence regarding the use of your voided check. This documentation can be crucial if discrepancies arise in processing payments or direct deposits down the line.

Alternatives to Using a Voided Check

If you don’t have a voided check on hand, there are several alternatives to consider. One option is to provide your bank account number and routing number directly. Most banks offer these details in online banking or on your monthly statements.

Another alternative is using direct deposit forms provided by your employer or service provider. These often include spaces for relevant banking information without needing an actual check.

You can also opt for digital payment platforms like PayPal, Venmo, or Zelle. Many companies accept these services for payments, reducing the need for checks altogether.

Some institutions allow you to set up automatic transfers through their mobile apps. This method provides convenience while ensuring that funds move securely between accounts without a physical check involved.

Conclusion

Voided checks can be an essential part of managing your finances. Understanding what they are and knowing when to use them can simplify various transactions, from setting up direct deposits to automating bill payments.

Using a voided check helps ensure accuracy in your financial dealings while providing security for both you and the institutions involved. By following the proper steps and avoiding common mistakes, you can take full advantage of this handy tool.

For those who might prefer alternatives, options like bank letters or electronic transfers may also cater to your needs. Whatever route you choose, having a firm grasp on how voided checks work is invaluable for anyone looking to streamline their financial processes.

By keeping these insights in mind, you’ll be better equipped to navigate the complexities of personal finance with confidence.